The Cost of Payment Processing in SEA & Mexico: A Comparison of Fees

Sample meta description.

Understanding Payment Processing Fees in Southeast Asia (SEA) and Mexico

So, you're setting up shop online in Southeast Asia (SEA) or Mexico? Awesome! That's a massive market with tons of potential. But before you get too carried away with visions of overflowing virtual shopping carts, let's talk about something crucial: payment processing fees. These little charges can eat into your profits if you're not careful. Think of them as the toll you pay to accept payments from your customers. This isn't some dry, boring topic, this is about maximizing your income! We're going to break down the different types of fees you'll encounter and compare costs across various providers in SEA and Mexico. We'll also give you some practical tips to minimize these expenses.

Decoding the Jargon: Types of Payment Processing Fees for E-commerce Businesses

Okay, let's get down to business. There's a whole alphabet soup of fees involved in payment processing. Don't worry, we'll translate it all for you.

- Transaction Fees: These are the bread and butter, the fees you pay every single time someone buys something from your online store. It's usually a percentage of the transaction amount plus a fixed fee. For example, it might be 2.9% + $0.30 per transaction.

- Interchange Fees: These fees are set by the card networks (Visa, Mastercard, etc.) and are paid to the card-issuing bank. They vary depending on the card type (credit, debit, rewards card), the merchant category code (MCC), and the region. Interchange fees are typically the largest portion of your processing costs.

- Assessment Fees: These are fees charged by the card networks to the payment processor. They're usually a small percentage of the transaction volume.

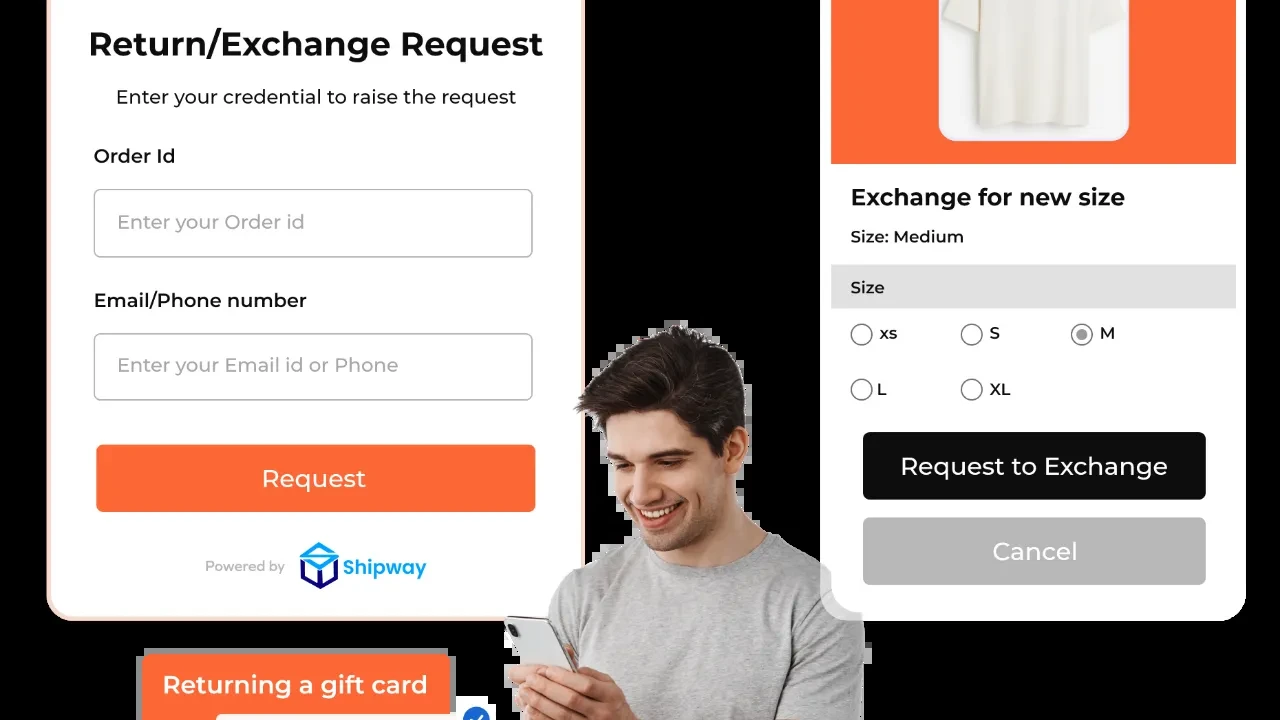

- Gateway Fees: If you're using a payment gateway to connect your website to the payment processor, you'll likely pay a monthly gateway fee. Think of the gateway as the secure bridge between your customer's payment information and your bank.

- Setup Fees: Some processors charge a one-time setup fee to get your account up and running. Try to negotiate these away if possible!

- Monthly Fees: Some processors charge a monthly fee to maintain your account, regardless of whether you process any transactions.

- Chargeback Fees: If a customer disputes a transaction and wins (resulting in a chargeback), you'll be charged a chargeback fee. These can be hefty, so it's important to have good customer service and fraud prevention measures in place.

- Currency Conversion Fees: If you're accepting payments in multiple currencies, you'll be charged a currency conversion fee when the funds are converted to your local currency.

Payment Processing Fees in Southeast Asia: A Country-by-Country Breakdown

SEA is a diverse region with varying levels of economic development and regulatory environments. This translates to different payment processing costs across countries. Let's take a look at some key markets:

- Singapore: Singapore is a highly developed market with a sophisticated financial system. Payment processing fees are generally lower than in other SEA countries. Expect to pay around 2.5% to 3.5% per transaction.

- Malaysia: Malaysia has a growing e-commerce market. Fees are slightly higher than in Singapore, ranging from 2.8% to 4% per transaction.

- Thailand: Thailand's e-commerce market is booming, but cash is still a popular payment method. Expect to pay around 3% to 4.5% per transaction.

- Indonesia: Indonesia is the largest e-commerce market in SEA, but it also has a complex regulatory environment. Fees can be higher, ranging from 3.5% to 5% per transaction.

- Philippines: The Philippines has a large and growing online population. Payment processing fees are generally in the range of 3% to 4.5% per transaction.

- Vietnam: Vietnam's e-commerce market is rapidly expanding. Expect to pay around 3.2% to 4.8% per transaction.

Payment Processing Fees in Mexico: Navigating the Options

Mexico's e-commerce market is also experiencing significant growth. However, like SEA, it has its own unique challenges and considerations. Here's what you need to know about payment processing fees in Mexico:

- Higher Fees Compared to the US: Generally, payment processing fees in Mexico are higher than in the United States. This is due to factors such as higher risk, less developed infrastructure, and regulatory complexities.

- Average Transaction Fees: Expect to pay around 3% to 5% per transaction, depending on the provider and the type of card used.

- The Importance of Local Payment Methods: While credit cards are widely used, it's crucial to offer local payment methods such as OXXO (a popular convenience store payment method) to cater to a wider customer base. These alternative payment methods may have different fee structures.

Comparing Payment Gateways and Payment Processors: SEA & Mexico E-commerce Solutions

Now, let's get into some specific examples. Here are some popular payment gateways and processors available in SEA and Mexico, along with their typical fee structures (remember, these can vary, so always confirm with the provider):

- Stripe: A global payment gateway popular in both SEA and Mexico. Offers a simple integration and a wide range of features. Typically charges around 2.9% + $0.30 per transaction in the US, but fees can be higher in SEA and Mexico (check local rates). Good for businesses of all sizes.

- PayPal: A well-known and trusted payment platform used globally. Offers buyer and seller protection. Fees vary depending on the country and transaction volume. Can be slightly more expensive than Stripe in some cases.

- 2Checkout (Verifone): Another global payment gateway that supports a wide range of currencies and payment methods. Offers advanced fraud protection. Fees are generally higher than Stripe and PayPal.

- Xendit: A popular payment gateway in Indonesia and other parts of SEA. Focuses on local payment methods and offers competitive pricing. Good for businesses targeting the Indonesian market. Pricing is often customized based on volume.

- Midtrans: Another leading payment gateway in Indonesia. Similar to Xendit, it supports local payment methods and offers a range of features. Also offers customized pricing.

- Mercado Pago: The leading payment platform in Latin America, including Mexico. Offers a wide range of payment options, including credit cards, debit cards, and cash payments through OXXO. Fees are competitive within the Mexican market.

- Clip: A popular mobile payment solution in Mexico. Allows businesses to accept credit and debit card payments using a mobile device. Good for small businesses and merchants who need a portable payment solution.

Product Recommendations: Choosing the Right Payment Solution for Your Online Shop

Okay, so which payment solution is right for you? It really depends on your specific needs and target market. Let's break it down:

- For Startups with a Global Focus: Stripe is a great option. It's easy to integrate, well-documented, and offers a wide range of features. The pricing is relatively transparent.

- For Businesses Targeting Indonesia: Xendit or Midtrans are excellent choices. They specialize in local payment methods and understand the nuances of the Indonesian market.

- For Businesses Targeting Mexico: Mercado Pago is a must-have. It's the dominant player in the market and offers a wide range of payment options that Mexican consumers expect.

- For Businesses Needing a Mobile Payment Solution in Mexico: Clip is a convenient and affordable option.

- For Businesses Wanting Brand Recognition: PayPal is a safe bet. Many consumers recognize and trust the PayPal brand.

Real-World Scenarios: How Different Businesses Use Payment Solutions

Let's look at some examples of how different businesses might choose a payment solution:

- A Small Online Clothing Boutique in Singapore: This business might start with Stripe due to its ease of use and relatively low fees. As they grow, they might add PayPal to offer more payment options to their customers.

- A Travel Agency in Indonesia: This agency would likely use Xendit or Midtrans to accept payments from Indonesian customers using local payment methods like bank transfers and e-wallets.

- An E-commerce Store Selling Handmade Crafts in Mexico: This store would definitely need to integrate Mercado Pago to cater to the local market. They might also use Clip to accept payments at craft fairs and markets.

Comparing Product Features: A Deep Dive into Payment Gateway Functionality

Beyond just the fees, you need to consider the features offered by each payment gateway. Here's a quick comparison:

- Stripe: Excellent API documentation, customizable checkout experience, support for subscriptions and recurring payments, advanced fraud protection.

- PayPal: Buyer and seller protection, easy integration with popular e-commerce platforms, support for multiple currencies.

- 2Checkout (Verifone): Global coverage, advanced fraud protection, supports a wide range of payment methods.

- Xendit: Focus on Indonesian payment methods, competitive pricing, good customer support in Indonesian.

- Midtrans: Similar to Xendit, offers a range of features tailored to the Indonesian market.

- Mercado Pago: Dominant in Latin America, supports local payment methods like OXXO, offers financing options for customers.

- Clip: Mobile payment solution, easy to use, affordable for small businesses.

Pricing Models: Understanding How Payment Processors Charge

Payment processors use different pricing models. Here's a breakdown:

- Flat-Rate Pricing: You pay a fixed percentage and a fixed fee per transaction, regardless of the card type. This is the simplest and most transparent pricing model. (e.g., Stripe's standard pricing)

- Interchange-Plus Pricing: You pay the interchange fee (set by the card networks) plus a fixed markup. This can be more complex to understand, but it can potentially be cheaper than flat-rate pricing, especially if you process a lot of transactions with lower interchange fees.

- Tiered Pricing: Transactions are categorized into different tiers based on risk, and each tier has a different fee. This is the least transparent pricing model and can be difficult to predict your costs.

- Custom Pricing: For high-volume businesses, you can often negotiate a custom pricing agreement with the payment processor.

Negotiating Lower Payment Processing Fees: Tips and Tricks

Don't be afraid to negotiate! Here are some tips to help you get lower fees:

- Shop Around: Get quotes from multiple payment processors and compare their fees and features.

- Negotiate Based on Volume: If you process a large volume of transactions, you have more leverage to negotiate lower fees.

- Ask for a Discount: Simply asking for a discount can sometimes work!

- Consolidate Your Payment Processing: If you use multiple payment processors, consider consolidating to one provider to get a better rate.

- Offer Incentives for Cash Payments: In some markets, cash is still a popular payment method. Offering a small discount for cash payments can help you avoid processing fees.

- Reduce Chargebacks: Chargebacks are expensive. Implement fraud prevention measures and provide excellent customer service to minimize chargebacks.

The Future of Payment Processing in SEA and Mexico: Trends to Watch

The payment landscape is constantly evolving. Here are some trends to watch in SEA and Mexico:

- The Rise of Mobile Payments: Mobile payments are becoming increasingly popular, especially in SEA. Expect to see more people using e-wallets and mobile payment apps.

- The Growth of E-wallets: E-wallets like GoPay, OVO, and Dana are gaining traction in SEA. Merchants need to support these payment methods to cater to local consumers.

- The Increasing Importance of Alternative Payment Methods: In both SEA and Mexico, it's crucial to offer alternative payment methods beyond just credit cards. This includes bank transfers, cash payments, and other local options.

- Increased Regulation: Expect to see more regulation in the payment processing industry, especially in areas like data security and consumer protection.

- The Adoption of Blockchain Technology: Blockchain technology has the potential to revolutionize payment processing by making it faster, cheaper, and more secure. However, adoption is still in its early stages.

Practical Steps to Minimize Payment Processing Costs: A Checklist for Online Shops

Okay, let's wrap it up with a practical checklist to help you minimize your payment processing costs:

- Understand the different types of payment processing fees.

- Compare fees from multiple payment processors.

- Negotiate lower fees based on your volume.

- Offer a variety of payment methods to cater to your target market.

- Minimize chargebacks by implementing fraud prevention measures and providing excellent customer service.

- Stay up-to-date on the latest payment trends and regulations.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)