Optimizing the Checkout Process for Your Online Shop in SEA & Mexico

Sample meta description.

Understanding the Payment Landscape in Southeast Asia (SEA) & Mexico: A Key to Checkout Optimization

Okay, so you're selling stuff online in Southeast Asia and Mexico? Awesome! These markets are HUGE, but they're also super diverse. What works in the US or Europe might completely bomb here. And a big part of that is payments. Forget everything you *think* you know about checkout. We're diving deep.

First things first, credit cards aren't king. Sure, some people use them, but you've got a whole bunch of other payment methods to consider. Think mobile wallets, cash-on-delivery (yep, still a thing!), and local bank transfers. Ignoring these is like leaving money on the table.

Why? Well, a lot of people in SEA and Mexico are "underbanked." They don't have credit cards, or they don't trust them for online purchases. They're more comfortable with options they know and trust. Plus, internet speeds can be spotty, and mobile is EVERYTHING. So, your checkout needs to be fast, mobile-friendly, and offer those alternative payment methods.

Key Challenges in SEA & Mexico Checkout Processes: Addressing Cart Abandonment with Localized Solutions

Cart abandonment is a killer, right? Especially when you've put in all that work to get someone to your site. In SEA and Mexico, there are specific reasons why people ditch their carts at the last minute. Let's break them down:

- Lack of Preferred Payment Options: We already talked about this, but it's worth repeating. If they don't see their preferred payment method, they're gone.

- High Shipping Costs: Shipping can be expensive, especially for cross-border orders. Be transparent about costs upfront. Surprise fees are a big no-no.

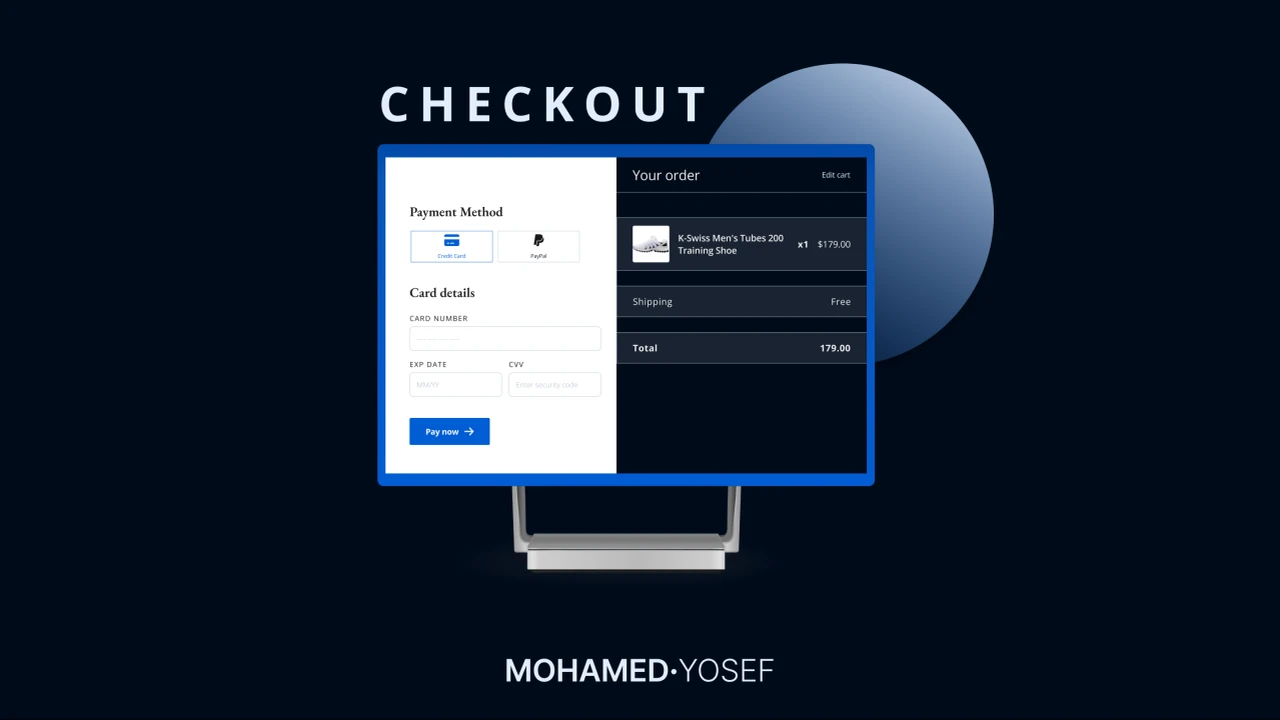

- Complex Checkout Process: Too many steps, too many fields to fill out, too much hassle. Keep it simple! Mobile users especially appreciate a streamlined experience.

- Security Concerns: People are wary of scams and fraud. Display trust badges and use secure payment gateways.

- Language Barriers: Offer your checkout in local languages. Even if your product descriptions are in English, the checkout process should be localized.

- Unexpected Taxes or Fees: Similar to shipping costs, unexpected charges during checkout are a surefire way to lose a customer.

Implementing Localized Payment Gateways: Examples and Use Cases for SEA & Mexico Online Shops

Okay, so which payment gateways should you be using? Here are a few options that are popular in SEA and Mexico:

- Southeast Asia:

- GrabPay (Southeast Asia): Super popular in Singapore, Malaysia, and other SEA countries. Integrated into the Grab app, which is used for everything from ride-hailing to food delivery. Great for mobile-first users.

- Gojek Pay (Southeast Asia): Similar to GrabPay, Gojek is another super app with a huge user base.

- ShopeePay (Southeast Asia): The payment arm of the Shopee e-commerce platform. If you're selling on Shopee, you definitely need to offer ShopeePay.

- PayMaya (Philippines): A leading digital wallet in the Philippines.

- GCash (Philippines): Another very popular digital wallet in the Philippines.

- FPX (Malaysia): Online banking transfers in Malaysia. Essential for reaching a large segment of the population.

- Doku (Indonesia): A leading payment gateway in Indonesia, supporting various payment methods.

- Mexico:

- Mercado Pago (Mexico & Latin America): Part of the Mercado Libre e-commerce platform. Widely trusted and used throughout Latin America.

- PayPal (Mexico): Still a popular option, especially for international customers.

- OXXO (Mexico): A unique payment method that allows customers to pay in cash at OXXO convenience stores. Crucial for reaching those without bank accounts or credit cards.

- SPEI (Mexico): Bank transfers in Mexico.

- Clip (Mexico): A mobile payment solution allowing businesses to accept card payments via a mobile card reader.

Use Cases:

- Selling fashion items in the Philippines: Offer PayMaya and GCash to cater to the dominant digital wallet users.

- Selling electronics in Mexico: Offer Mercado Pago and OXXO to cover both online and cash payment preferences.

- Selling digital services in Malaysia: Offer FPX for convenient online banking transfers.

Product Comparisons: Evaluating Payment Gateway Features, Fees, and Integration Options for SEA & Mexico

Choosing the right payment gateway isn't just about popularity. You need to consider fees, features, and how well it integrates with your e-commerce platform. Let's compare a few options:

| Payment Gateway | Region | Fees (Approximate) | Key Features | Integration |

|---|---|---|---|---|

| GrabPay | Southeast Asia | 1.5% - 2.5% per transaction | Mobile-first, loyalty program integration, wide user base | API, plugins for major e-commerce platforms |

| Mercado Pago | Mexico & Latin America | 2.99% - 3.99% + fixed fee per transaction | Installment payments, fraud protection, easy integration with Mercado Libre | API, plugins for major e-commerce platforms |

| OXXO | Mexico | Fixed fee per transaction (around $0.50 - $1 USD) | Cash payments, reaches unbanked population | Requires specific integration with payment gateways |

| PayPal | Global (including SEA & Mexico) | 2.9% + fixed fee per transaction | Widely recognized, supports multiple currencies, buyer protection | API, plugins for major e-commerce platforms |

Things to consider:

- Transaction Fees: These can eat into your profits, so compare carefully.

- Setup Fees: Some gateways charge setup fees, while others don't.

- Currency Support: Make sure the gateway supports the currencies you need.

- Fraud Protection: Look for gateways with robust fraud prevention measures.

- Ease of Integration: Choose a gateway that integrates easily with your e-commerce platform.

- Payout Schedule: How often will you receive your funds?

Mobile Optimization Strategies: Enhancing the Checkout Experience for Mobile Shoppers in SEA & Mexico

Remember, mobile is HUGE in SEA and Mexico. Your checkout needs to be optimized for smaller screens and slower internet connections. Here are some tips:

- Responsive Design: Make sure your checkout is responsive and looks good on all devices.

- Simplified Forms: Minimize the number of fields users need to fill out. Use auto-fill features where possible.

- One-Page Checkout: Consolidate the checkout process into a single page to reduce loading times.

- Large Buttons: Make buttons easy to tap on small screens.

- Progress Indicators: Show users where they are in the checkout process.

- Optimize Images: Compress images to reduce loading times.

- Use a CDN (Content Delivery Network): CDNs can help speed up your website by caching content on servers around the world.

Payment Security Best Practices: Building Trust and Reducing Fraud in Online Transactions for SEA & Mexico

Security is paramount. You need to build trust with your customers and protect their financial information. Here are some best practices:

- SSL Certificate: Use an SSL certificate to encrypt data transmitted between your website and your customers' browsers.

- PCI DSS Compliance: If you're handling credit card information, you need to be PCI DSS compliant.

- Fraud Detection Tools: Use fraud detection tools to identify and prevent fraudulent transactions.

- 3D Secure Authentication: Implement 3D Secure authentication (e.g., Verified by Visa, Mastercard SecureCode) for added security.

- Address Verification System (AVS): Use AVS to verify the billing address provided by the customer.

- CVV Verification: Require customers to enter the CVV code on the back of their credit cards.

- Monitor Transactions: Monitor transactions for suspicious activity.

Showcasing Specific Payment Product Examples and their Pricing for SEA & Mexico

Let's get down to brass tacks and look at some specific examples and their approximate pricing. Keep in mind these are estimates and can vary depending on your business size and negotiated rates.

- PayMaya (Philippines):

- Product: Digital wallet and payment gateway.

- Use Case: Accepting payments on your e-commerce website or mobile app.

- Pricing: Typically around 1.5% - 2.5% per transaction. May have different tiers based on volume. Check their website for current pricing.

- GCash (Philippines):

- Product: Digital wallet.

- Use Case: Similar to PayMaya, popular for mobile payments.

- Pricing: Similar to PayMaya, around 1.5% - 2.5% per transaction.

- Mercado Pago (Mexico):

- Product: Payment gateway and online payment processing.

- Use Case: Accepting credit cards, debit cards, and cash payments (through OXXO) on your website.

- Pricing: Varies based on plan and payment method. Can range from 2.99% + a fixed fee to higher percentages for installment payments. Check Mercado Pago's website for updated pricing.

- OXXO (Mexico):

- Product: Cash payment network.

- Use Case: Allows customers to pay in cash at OXXO convenience stores.

- Pricing: Typically a fixed fee per transaction, around $0.50 to $1 USD. The fee is usually absorbed by the merchant.

- Clip (Mexico):

- Product: Mobile Point-of-Sale (mPOS) system.

- Use Case: Accepting card payments in person using a mobile card reader connected to a smartphone or tablet.

- Pricing: A percentage-based fee per transaction, usually around 3.6% + IVA (Value Added Tax). You'll also need to purchase the Clip card reader.

Important Note: Always contact the payment providers directly for the most accurate and up-to-date pricing information. Fees and terms can change.

A/B Testing Your Checkout Process: Data-Driven Optimization for Improved Conversion Rates in SEA & Mexico

Don't just guess what works best. A/B testing is your friend! Test different versions of your checkout to see which one performs better. Here are some things you can test:

- Payment Gateway Placement: Where do you display the payment options?

- Button Colors: Do different button colors affect conversion rates?

- Form Layout: Is a single-column or multi-column form better?

- Text on Buttons: Does "Buy Now" perform better than "Proceed to Checkout"?

- Number of Form Fields: Can you remove any unnecessary fields?

- Trust Badges: Do trust badges increase confidence and conversions?

Use tools like Google Optimize or Optimizely to run your A/B tests. Track your results carefully and make changes based on the data.

Future Trends in Online Payments for SEA & Mexico: Staying Ahead of the Curve in a Dynamic Market

The world of online payments is constantly evolving. Here are some trends to watch in SEA and Mexico:

- Increased Adoption of Mobile Wallets: Mobile wallets like GrabPay, Gojek Pay, PayMaya, and GCash will continue to grow in popularity.

- Buy Now, Pay Later (BNPL) Services: BNPL services are becoming increasingly popular, allowing customers to spread out payments over time.

- Cryptocurrencies: While still niche, cryptocurrencies could become more mainstream in the future.

- Biometric Authentication: Biometric authentication (e.g., fingerprint scanning, facial recognition) could become more common for online payments.

- Real-Time Payments: Real-time payment systems are emerging, allowing for instant transfers between bank accounts.

Staying informed about these trends will help you stay ahead of the curve and provide the best possible checkout experience for your customers.

Promotional Strategies for New Payment Options: Incentivizing Customers to Adopt New Payment Methods in SEA & Mexico

So you've integrated a new payment method. Great! Now, how do you get people to use it? Here are some promotional strategies:

- Discounts and Promotions: Offer a discount for using a specific payment method. For example, "Get 10% off when you pay with GrabPay!"

- Cashback Rewards: Provide cashback rewards for using a particular payment option.

- Partnerships: Partner with the payment provider to offer exclusive deals to their users.

- Educational Content: Create blog posts or videos explaining how to use the new payment method.

- Social Media Campaigns: Run social media campaigns to promote the new payment option.

- Email Marketing: Send emails to your subscribers announcing the new payment method and highlighting its benefits.

- In-App Promotions: If you have a mobile app, promote the new payment method within the app.

- Limited-Time Offers: Create a sense of urgency by offering a limited-time promotion for using the new payment method.

- Free Shipping: Offer free shipping for orders paid with a specific payment option.

- Loyalty Programs: Integrate the new payment method into your loyalty program to reward customers for using it.

Remember to tailor your promotional strategies to your target audience and the specific payment method you're promoting.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

in SEA & Mexico.webp)